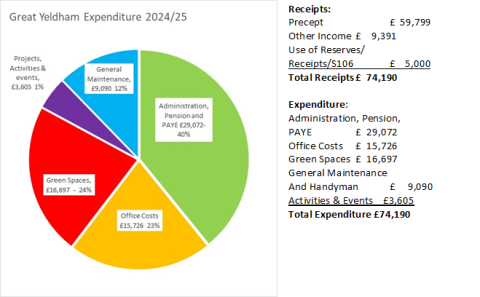

Great Yeldham Parish Council finances its activities from part of the Council Tax (the Precept) paid by households in the parish and is collected by Braintree District Council at the same time it collects the council tax money for Essex County Council, the Police and the Fire Service. The parish council precept maintains the Burial Grounds (the Lawn Cemetery, Garden of Remembrance and The Glades Natural Burial Ground, Play Park, Sports and Recreation Ground, open spaces, verges and footpaths, events including seasonal activities and the Christmas Tree and Carol Service, the provision of the Handyman Service and general maintenance costs for the upkeep of the village; and essential administration costs to ensure that the Parish Council fulfils its legal obligations and financial responsibilities.

Precept 2024/25

Local government is currently facing significant financial pressures and unfortunately Great Yeldham is not immune to them. We know these challenges are felt by many of our residents too. However, given the current economic outlook and demand pressures, it is something we are unable to avoid. The Parish Council has continued to find further efficiency savings across the budget, where it can. Yet, there are some inflationary increases which are unavoidable and additional commitments including £1,200 to hire the village hall for the Outreach Post Office Service; maintenance of Bowtells Meadow when transferred to the Parish Council estimated at £4k; increased costs for grounds maintenance works including grass cutting, verges, footpaths (maintained by the parish), hedges and tree works.

At the Parish Council meeting held on 11th January 2024, Councillors agreed from April 2024 the precept will increase to £59,799, which represents the Parish element on Council Tax Band D Annual Charge of £88.91 (a rise of £7.91 from 2023/24. The Parish Council will continue to identify savings and welcomes suggestions from residents.

Further budget information can be found at the below links:

2024-25 Precept and Budget Parish Precept Form 2024-25

2023-24 Precept and Budget Parish Precept Form 2023-24

2022/23 Budget and Precept Parish Precept Form 2022-23

2021/22 Precept and Budget Parish Precept Form 2021-22

2020/21 Precept and Budget Parish Precept Form 2021-22

2019/20 Precept and Budget Parish Precept Form 2020/21

2018/19 Precept and Budget Parish Precept Form 2019/20

2017/18 Precept and Budget Parish Precept Form 2018/19

2016/17 Precept and Budget Parish Precept Form 2016/17